Immigrating to the United States is the dream of many across the globe. America has historically been viewed as a land of opportunity, where anyone can make it if they just work hard enough. However, gaining legal entry through the proper immigration channels can be an arduous process – especially when it comes to proving you have adequate financial resources.

This has led some applicants to resort to using fake bank statements to exaggerate their assets and meet minimum income requirements. But while using phony financial documents may seem like an easy shortcut, this fraudulent approach can destroy your immigration aspirations and land you in legal trouble if caught.

Also check out: How Long Does the U.S. Embassy Keep Record Of Visa Denial? (section 221(g) of the Immigration and Nationality Act)

Why Do Visa Applicants Use Fake Statements?

There are two primary motivations for visa applicants to submit counterfeit bank records:

1. To Demonstrate Financial Stability

One of the key criteria that USCIS officers evaluate is whether an immigrant will be likely to become a “public charge” – someone dependent on government assistance programs due to lack of financial resources.

Many visa categories (including family-based green cards and temporary work visas) require the applicant to prove they won’t become a public charge by meeting minimum income requirements. For example, if you’re immigrating through marriage to a US citizen, you’ll need to provide evidence you earn at least 125% of the Federal Poverty Guidelines.

By using falsified account statements padded with extra assets, applicants hope to increase their chances of meeting the monetary thresholds set forth for their visa type.

2. To Cover Up Poor Financial History

In addition to assessing minimum income criteria, USCIS also reviews your broader financial profile – including your credit history, debts, past rent payments, and more. The goal is to determine your level of financial responsibility over time.

Many applicants seeking to immigrate – especially younger people or those from developing nations – may have limited or problematic financial histories. Examples include late rent payments, unpaid debts, minimum wage jobs, filed bankruptcies, etc.

To avoid jeopardizing their immigration efforts, these applicants may fabricate fake bank records depicting a rosier financial picture than really exists.

Common Ways Fraudsters Falsify Financial Docs

While guidelines prohibit using fake documents in immigration applications, the internet has made generating convincing forgeries surprisingly straightforward. Some common ways include:

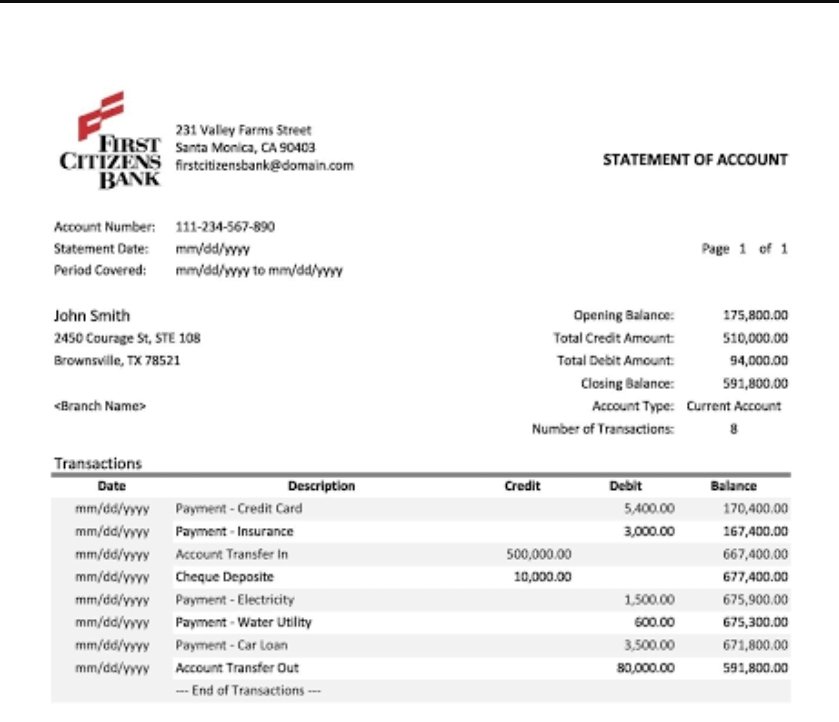

High Quality Mock-Ups

Thanks to modern software and printing capabilities, fraudsters can create mock bank statements closely resembling the real thing. Templates allow customizing all aspects of the document like:

- Name/address records

- Logos & visual elements

- Digital signatures & seals

- Format, margins & alignments

With attention to detail, the counterfeit can be hard to visually distinguish from valid records.

PDF Editing

Savvy scammers realize examining a PDF’s back-end code can reveal its forged origins. So rather than building statements from scratch, some start with a valid document and use PDF editors to tweak details like:

- Altering names

- Modifying balances

- Adding/editing transactions

- Changing dates

Since the underlying DNA matches a real statement, this makes detection much harder.

Custom Activity Fabrication

Instead of editing an existing file, fraudsters may create fake bank accounts showing months of plausible transaction history. This could include typical expenses like:

- Rent/mortgage payments

- Utility bills

- Paycheck deposits

- Cash withdrawals

- Debit card purchases

constructing an account with real-looking activity makes confirmation difficult for investigators without underlying financial records.

Questionable Legality

Can applicants truly get in legal trouble for bank statement misrepresentations? Consider:

Novelty Statements Have Grey Area Status

Websites offering mock bank statements as gag gifts or movie props occupy a legal grey zone in many jurisdictions. After all, creating a silly fake document just for laughs is vastly different than using it to intentionally defraud someone. So while ethically questionable, novelty statements themselves may not constitute outright illegal behavior in certain contexts.

Using Fakes for Fraud Crosses the Line

However, submitting false financial records to government agencies as part of an immigration application is unambiguously against the law.

Both State and Federal legislatures have enacted clear statutes prohibiting making deceptive statements or using fabricated evidence to obtain visas or government benefits. For example, under 18 U.S. Code § 1546, penalties for immigration fraud can include:

- Up to 10 years in federal prison

- Massive fines exceeding $250,000

- Permanent visa application ban

So while novelty statement templates themselves may live in a legal grey zone, actually deploying them to swindle immigration authorities crosses deep into criminal territory.

Red Flags: How USCIS Detects Fake Bank Statements

Given the gravity of penalties involved, how likely is it that US Citizenship & Immigration Services officers catch applicants using fraudulent bank records? Unfortunately for wrongdoers, very likely.

USCIS Fraud Detection and National Security (FDNS) agents are specifically trained to recognize duplicate, forged and fabricated financial documents.

Human Document Examination

FDNS officers are experts in manually examining bank statements for red flags like:

- Inconsistent or missing meta/issue dates

- Low-quality or improper logos

- Alignment issues (crooked rows/columns)

- Grammar and spelling errors

Experts also scrutinize the actual transactions – fake accounts often appear too orderly and consistent to be real.

Forensic Analysis Software

In addition to manual reviews, USCIS also leverages specialized financial forensics software deploying advanced statistics and machine learning to detect fraudulent documents.

Capabilities include:

- Recognizing duplicate statements

- Identifying statement manipulation

- Verifying document metadata

- Uncovering modified PDF code

Together, human and technical techniques make successfully sneaking fake records past authorities extremely challenging.

Harsh Consequences of Using Fake Bank Statements

Given the robust protections against financial forgeries immigration authorities have in place, what happens when they catch an applicant using phony bank records? Dire consequences typically ensue:

Certain Visa Denial

At best, submitting falsified financial documents immediately disqualifies the associated immigrant visa application. Section 212(a)(6)(C) of the Immigration and Nationality Act permits USCIS to deny any visa petition suspected of containing fraudulent content. Using fake bank statements unambiguously triggers this statute.

Potential Criminal Charges

As discussed, both State and Federal laws prohibit using fabricated evidence within immigration proceedings. Offenders often face prosecution, especially in egregious cases. Charges can include passport fraud, visa fraud, identity fraud as well as forgery and counterfeiting charges.

Multi-Year Visa Ban

Those caught committing immigration fraud face a 5-10 year ban on filing new non-immigrant and immigrant visa petitions according to INA § 212(a)(6)(C)(i). This applies even to categories like political asylum otherwise exempt from restrictions. Some exceptions exist for innocent relatives of fraudsters, but most perpetrators face stiff barriers even after avoiding jail time.

Given these severe sanctions, clearly applicants face extreme risk seeking immigration shortcuts through financial statement misrepresentations. Yet some still feel desperation outweighs the consequences. Let’s explore why.

What Drives Applicants to Take the Risk?

Despite realizing the dangers, why do some visa applicants still resort to questionable financial practices like bank statement forgery? In many cases, feelings of frustration and desperation override better judgement:

Lengthy Immigration Backlogs

Over 30 million foreign-born individuals currently reside in the US legally. Yet close to 2 million more await processing stuck within tedious immigration backlogs stemming from application overload.

As of January 2023, Indians with advanced degrees applying today won’t receive green cards for 99 years at current rates. Even spouse/child green card applicants face 10 year queues.

Faced with such agonizing delays, it’s no wonder applicants seek ways to shortcut the system.

Prohibitive Income Requirements

Minimum income rules also constrain applicants. Consider that 2023 Federal Poverty Guideline minimums require sponsoring households like US citizen spouses to earn at least $23,618 annually. This proves daunting for lower-middle class families.

Meanwhile, poor migrants working tough jobs just to survive likely lack any excess income for compliance. Little surprise then that some succumb to manufacturing rosy financial pictures rather than abandoning immigration hopes.

Fear of Rejection & Appeals Difficulty

Finally, fundamental fear of rejection psychologically motivates deception. Applicants mortify at seeing years of immigration efforts squandered by financial issues beyond their control.

Complicating matters, appealing rejections proves notoriously difficult – USCIS denies roughly 93% of appeals according to its own statistics.

Given this rigid system, applicants cling to shady methods to gain initial admission rather than face the agency’s daunting appeals gauntlet.

While sympathetic communities may empathize with families seeking better lives, the ends still don’t justify illegal means. However, emerging technologies may offer solutions appeasing all sides.

AI Assisted Immigration Solutions Emerge

Rather than overlooking unscrupulous actions of those flouting the system, experts aim to address motivators like backlogs and income requirements directly. AI-optimized immigration software is one promising development.

Expediting Applicant Processing

Leveraging intelligent algorithms and automation, these systems accelerate applicant processing to reduce prohibitively long backlogs. Applicants receive immigration determinations much faster so less temptation exists to circumvent procedures.

Enhancing Financial Validation Checks

AI also enhances authorities’ abilities to quickly validate bank statements and other financial documents. This results in faster visa confirmations for legitimate applicants with honest applications.

Increasing System Fairness And Transparency

AI further helps reduce biases human reviewers may introduce. Objective algorithmic decisions based purely on legal protocols increase applicant confidence in receiving fair outcomes compliant with immigration rules.

Overall such technologies promise easier paths for financial statement verification, immigration backlog reduction and just applicant treatment.

Best Practices for Avoiding Immigration Fraud Entanglements

Rather than flirting with fate using questionable bank statement practices, the wisest choice for applicants involves maintaining strict financial integrity. Here are some tips:

1. Remain Truthful on All Immigration Applications

However dire your situation appears, resist the urge to embellish reality or outright lie on financial forms. Understanding officers aim to help worthy applicants…as long as ethical rules are followed.

2. Consult Immigration Attorneys With Concerns

Reputable immigration lawyers exist to facilitate successful applicant outcomes the lawful way. If minimum income rules prove problematic, discuss options rather than cutting corners. Perhaps eligible visa categories more leniently handle finances.

3. Leverage Financial Tools Maximizing Immigration Odds

If income shortcomings hurt your odds, financial tools like credible cosigners, permitted pre-paid support or joint sponsorships may help overcome hurdles ethically. Ask your immigration lawyer for legitimate arrangements optimizing approvals.

The road to US immigration may challenge even the most patient souls. But resist shortcuts attempting to swindle the system. With ethical perseverance and legitimate financial preparations, your immigration success can be won the right way.

Leave a Comment